- Muir Park Basketball Court Mural

- Winn Park Lighting Project

- Paragary Pathway Lighting Project

- Streetlight Pole Banner Program

- Temporary Wayfinding

- Al Fresco Dining

- Walk Alhambra Wayfinding

- Utility Box Wraps

- Trash Bin Wraps

- Dumpster Wraps

- Murals

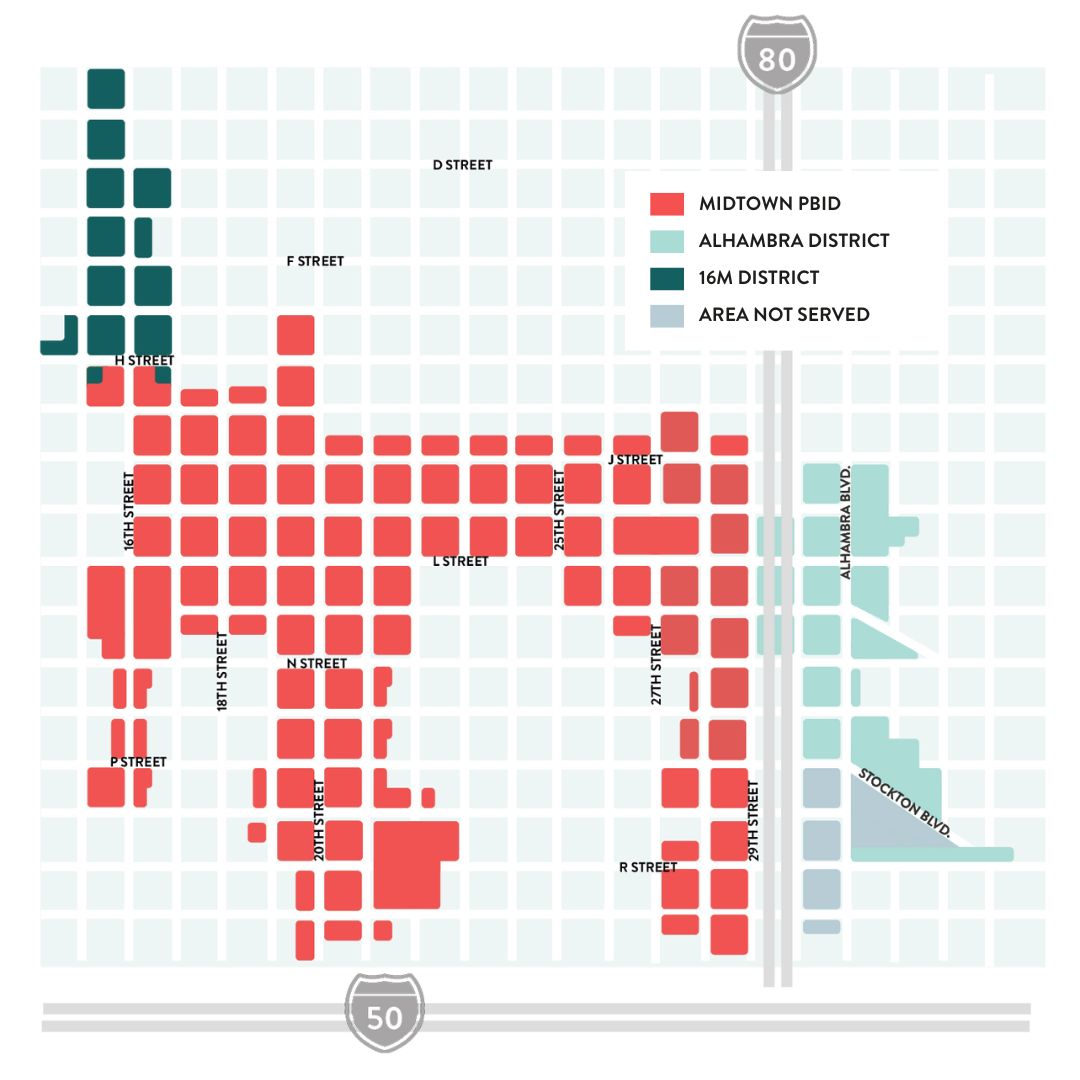

The Midtown Association seeks to help Midtown stakeholders thrive. We promote a welcoming environment, provide a clean & safe community, communicate the uniqueness of Midtown, and encourage wellness through investments in parks and open spaces. Below is an outline of the services and resources Midtown Association provides and information on how to reach out for support.

Thank you to our sponsor SMUD for supporting small businesses. Click here to learn more about SMUD’s SEED (Supplier Education and Economic Development) program and their incentives to local small businesses.

Clean and Safe Services

- Loitering or trespassing on private property (non-violent) or ongoing issues so we can provide proactive property checks

- Homeless outreach services

- Graffiti, biohazard, litter, abandoned encampment, human waste, debris or sticker removal

- Gutter and storm drain cleaning

- Power washing

Additional Clean and Safe Support

Call 9-1-1 for emergencies, crime in progress, or suspicious and aggressive behavior

Call (916) 808-5471 (Sacramento Police Department Non-Emergency) to report past crimes or property break-in

Call 3-1-1 for code or water use violations, large illegal dumping pick-up, street sign damage, traffic light issues, or crosswalk issues

Clean and Safe Support Request

If your business or property is not located within the district but you would like to receive Clean and Safe services, please email luis@exploremidtown.org to request an estimate.

In honor of Midtown Association’s 40th Anniversary in 2025, 40 businesses in Midtown’s PBID district boundaries will receive a free one-year subscription to the City of Sacramento’s integrated security camera network, Sacramento PD Connect. For more information and to apply for your business to receive this subscription, visit our form here.

Service Hours

Monday – Friday 7 a.m. – 6 p.m.

Saturday 7 a.m.–3:30 p.m.

Midtown

916-287-9867dispatch@exploremidtown.org

Alhambra District

916-287-9272dispatch@alhambracorridor.com

16th Street

916-465-826616m@exploremidtown.org

Communication and Event Support

Midtown Association can help promote your business and business happenings throughout the Central City. In addition to promotion, our communications team also invests in special events by offering services that encourage hosting activities and events within the district boundaries. Our support includes the following communications and event services:

- Social media posts and stories highlighting your business or business happenings

- Monthly newsletter mentions

- Road closure support using bollards

- Permit assistance

- Promotion of event

- Access to Clean & Safe services

To receive support for event services, complete the request form at least two weeks before the event’s start date, but the earlier, the better, so we can accommodate your specific needs. Please provide as much information as possible, and our team will be in touch within three business days of your submission. For complete event support information and guidelines, reference the Event Support Toolkit. For resources specific to Second Saturday, reference the Second Saturday Resources Page.

For information on sponsorship opportunities, view our Partner With Us Page.

Please note that Event Support Services are unavailable from July 1, 2025 – January 15, 2026.

Placemaking and Capital Improvements

The Placemaking & Capital improvement program creates dynamic and active public spaces to make Midtown the center for culture, creativity, and vibrancy in Sacramento’s urban core.

Pilot Projects

Capital Improvements

- Truitt Bark Park All-Weather Shade Structures

- Bike Share Stations

- J Street Protected Bike Lanes

- Fremont Park Electrical Upgrades

- Sutter Traffic Safety Project

- EV Charging Station

- Bollards

- Sutter’s Fort Lighting Project

Advocacy and Economic Development

Midtown Association supports and encourages our stakeholders to play a role in shaping the policies that impact our city and region. The organization has four areas of focus including:

- Infill Development

- Create mixed-use, multi-modal focused infill development, reduce barriers to development through streamlining, and research and apply innovative and creative building design for greater density.

- Clean & Safe

- Increased safety through a reduction in crime rate, decrease homelessness in the community, and build pride in the community through maintenance.

- Infrastructure & Capital Improvements

- Attract investments by leveraging PBID funds with outside sources, invest in ambient lighting and small landscaping efforts, and activate the district through pedestrian and bicycle activities.

- Active Transportation

- Advocate for active transportation infrastructure, increase and diversify public transportation, and promote growth of innovative car share and autonomous vehicle use.

BID Services

An enhanced level of support is provided to restaurants within two restaurant districts (Business Improvement Districts) in the Midtown Sutter and Midtown Central areas. Services are developed to specifically increase business for restaurants within the boundaries of the districts and include:

- Lighting and Safety

- Ambient lighting enhancements and enhanced security

- Placemaking, Arts, and Events

- Block parties, farmers markets and other event programming

- Murals and public art

- Themed landscaping

- Advocacy & Administration

- Business and districtwide promotions via social media and newsletters

- Al Fresco Dining support